| Last Close | 1.0261 |

| % Change | 0.05% |

| 1 year % Change | -13.46% |

| 1 year Range | 0.9952-1.1910 |

| Resistance 3 | 1.0350 |

| Resistance 2 | 1.0280 |

| Resistance 1 | 1.0250 |

| Pivot Point |

1.0234 |

European natural gas prices rose on Tuesday, as investors sought an update on Russian supplies amid rising energy demand in the region.

Russia's Gazprom curbed flows on the main Nord Stream pipeline to about 20% of capacity last week, and flows have remained near that level or lower since the weekend.

And the German company “Covestro AG” - a provider of high-tech polymers - warned in a statement on Tuesday of the risks of rationing gas flows, noting the close links between the chemical industry and the downstream sectors, and the impact of the deterioration of the situation further on the entire supply and production chains.

Russian supply volumes in the coming weeks - as well as the EU's ability to reduce consumption and attract LNG from Asia - will determine whether enough fuel can be stored for the winter in Europe, whose facilities are about 69 percent full so far.

| 1H | down |

| 5H | down |

| DAILY | down |

| WEEKLY | down |

| Time | Currency | Impact | Event |

|---|---|---|---|

| NA | NA | NA | NA |

| NA | NA | NA | NA |

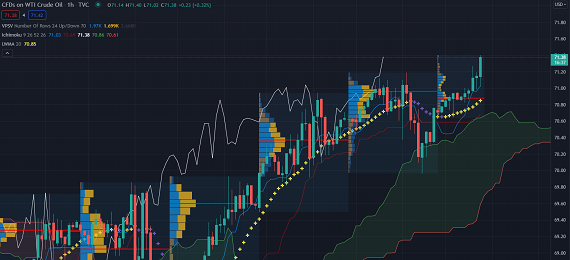

| Last Close |

93.89 |

| % Change |

-0.88 % |

| 1 year % Change | 26.27% |

| 1 year Range | 61.74-130.50 |

| Resistance 3 | 96.30 |

| Resistance 2 | 95.70 |

| Resistance 1 | 95.00 |

| Pivot Point |

94.20 |

| Support 1 | 93.60 |

| support 2 | 93.00 |

| Support 3 | 92.70 |

Oil prices fell during trading on Tuesday, as the two oil contracts continued to expand their losses and Brent crude fell below $100 a barrel, amid investors' expectations of a decline in demand for fuel and oil derivatives, with the release of data indicating an economic slowdown in the major economies of the world.

oil prices

In terms of trading, the prices of futures contracts for Brent crude for September delivery decreased by 0.62%, or the equivalent of 0.62 dollars, to reach 99.20 dollars per barrel.

For its part, the prices of US West Texas Intermediate crude futures for August delivery also decreased by 0.36%, or the equivalent of $0.34, to record $93.56 a barrel.

This decline comes after both contracts ended trading on Monday with a significant decline, and the prices of the two crudes reached their lowest levels in more than two weeks.

| 1H | up |

| 5H | up |

| DAILY | up |

| WEEKLY | up |

| Time | Currency | Impact | Event |

|---|---|---|---|

| NA | NA | NA | NA |

| NA | NA | NA | NA |

| Last Close |

1763 |

| % Change | 0.24% |

| 1 year % Change | -3.66% |

| 1 year Range | 1704-2070 |

| Resistance 3 | 1800 |

| Resistance 2 | 1793 |

| Resistance 1 | 1785 |

| Pivot Point | 1778 |

| Support 1 |

1772 |

| Support 2 | 1765 |

| Support 3 | 1758 |

(Reuters) - Gold gave up early gains to trade flat on Tuesday as the US dollar rose, lower Treasury yields and growing recession fears kept the yellow metal near its four-week peak.

And gold settled in spot transactions at about 1771.29 dollars an ounce by 0843 GMT, after hitting its highest level since July 5, earlier in the session, at 1780.39 dollars.

In the US futures contracts, there was no change in the price of gold to record 1787.10 dollars an ounce.

Giovanni Stonovo, an analyst at UBS, said that the decline in real interest rates in the United States has supported gold recently.

| 1H | up |

| 5H | up |

| DAILY | up |

| WEEKLY | up |

| Time | Currency | Impact | Event |

|---|---|---|---|

| NA | NA | NA | NA |

| NA | NA | NA | NA |